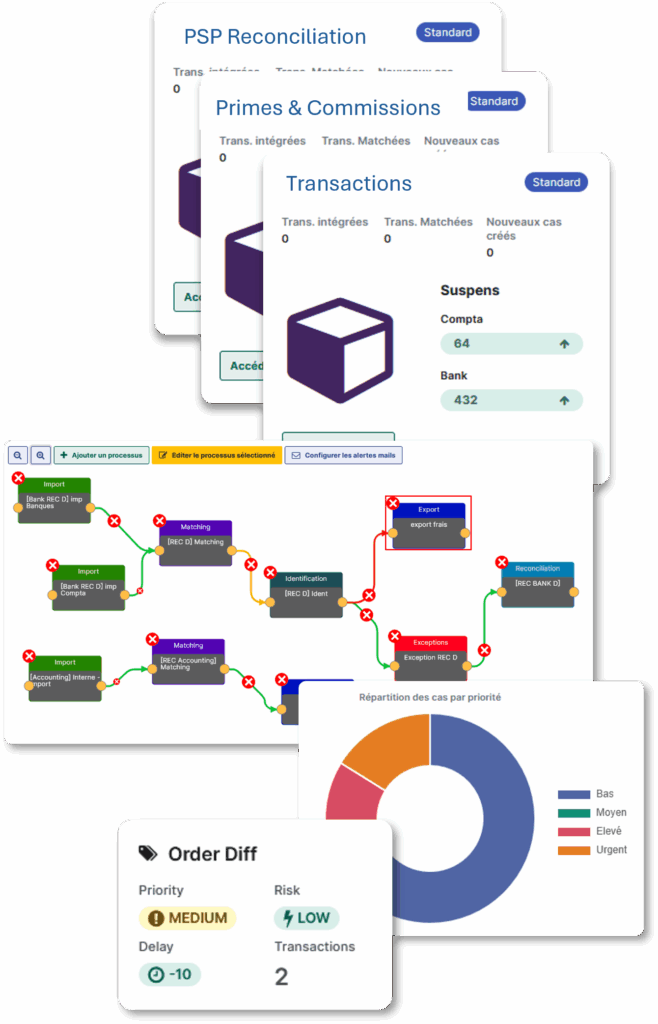

Payment reconciliation mastered : from first click, to the last cent

Obtain exhaustive and automated transactional reconciliation, capable of absorbing your most massive volumes, while detecting discrepancies the moment they appear. Master each transaction, from authorization to settlement — every payment is tracked, matched and justified.

Calixys will be at Tech for retail 2025 to presents its solutions for a fast-moving sector

Features designed for the complexity of payement flows

Multi-party transactional reconciliation

Credit card, wallet, bank transfer, BNPL, crypto payments: XREC reconciles every transaction regardless of the payment method or provider. Whether you are trying to reconcile data from multiple PSPs, merchants, or entities, the multipartite reconciliation feature allows you to reconcile several sources in a few clicks, without unique matching and without useless duplications.

Cross-border and multi-currency transaction management

With international payments, exchange rate variations and banking delays generate discrepancies. XREC takes these parameters into account to ensure precise matching, even on massive and multi-currency volumes.

Tracking micro-transactions and fractional payments

Ideal for gaming, streaming platforms or subscription services: each micro-payment is consolidated and tracked, even when it is split or grouped for settlement.

Multi-systems integration and normalization

XREC connects to your PSPs, internal systems, e-commerce platforms and billing tools. Data is harmonized whether it comes from proprietary files or standard formats (ISO 20022, CSV, API).

Improve merchant relationship and transparency

Reliable merchant

payouts

With XREC, you can guarantee exact and punctual payouts to your merchants, no matter the complexity of the flows or currencies. Each amount is justified, reducing disputes.

Operational and business reporting

Automatic detection and classification of discrepancies free you to focus only on analysis and resolution. Fraud detection, risk management and audit preparation are made much easier and more performant.

Expert support for rapid deployment.

From our payment experts to your operational teams

De nos experts paiements à vos équipes opérationnelles

Our specialists know the realities of PSPs, pure players and payment actors. They work hand in hand with your finance, payments and IT teams.

From flow mapping to business rule configuration, every step is designed to integrate with your existing environment and reflect your internal processes.

Tolerances, priorities, exclusions, validation workflows — your constraints and your reality are studied and the platform customized.

Result: a smooth deployment, rapid adoption, and measurable return on investment from the first closing cycles.

Payment leaders already optimising

their financial flows with Calixys

From PSPs to e-merchants, our clients use XREC to secure their flows, reduce discrepancies and strengthen partner trust.