Automatic multi-way transaction matching; a focus on e-merchants

Publié

Le 21/02/2024, par :

- Anne Marie Diom

Sections

Contexte

When talking about reconciliation in general, it is always about comparing data. The goal here is always to compare dissimilar sources of data to analyze them, identify any discrepancies and certify their accuracy.

There are of course several types of reconciliation. We can quote here bank reconciliation, securities reconciliation or even portfolio reconciliation. In most cases reconciliation involves comparing only 2 different sources of data. The aim is to ensure that all flows recorded in one source are also recorded in the other source. It is this matching that enables discrepancies to be detected.

But there are also other cases where several data sources are compared. This is known as multi-way reconciliation.

Three-way reconciliation / multi-way reconciliation; definition

Now that we have defined reconciliation or 2-way reconciliation, we can dive into the concept of multi-way reconciliation. Well, it aims for the same goal only this time, it involves 3 or more different systems of record.

To better grasp the difference between these two types of reconciliation let’s take an example:

Imagine you have a data source with all the purchases order and another one with all the invoices. To make sure everything aligns and avoid possible mistakes you are going to verify that every purchase order matches an invoice, that the amounts are the same and the dates make sense. This right here is a normal reconciliation or a two-way reconciliation.

Doing a 3-way reconciliation will just add another step: you need now to compare all your purchase orders with all your invoices and your sales receipts. If every purchase order has an invoice and a receipt and all data is matching, you have succeeded in your 3-way reconciliation!

It is important to note also that we can do 4-way or even 7-way reconciliation. When a reconciliation involves 3 or more entries / data sources, we call it multi-way reconciliation or multi-way transaction matching.

Multi-way reconciliation can be necessary in diverse situations and is illustrated by numerous examples. In the insurance industry it is not uncommon to do 4-way reconciliations as we must analyze the records of the contracts, the bonuses, the general accounting, and the bank. The same goes for e-commerce where 3-way reconciliation is a mandatory step for the finance departments and carries its own challenges and complexities.

What about e-commerce?

A few basics

Now let’s focus our attention on the e-commerce industry, and its particularities. As said before 3-way reconciliation is unavoidable for e-businesses. For better understanding we will take an example, but before that it is necessary to explain the 4 types of e-commerce one can identify.

- The e-merchants are classics online store that sell products or services online.

- B2B2C Marketplace are Marketplaces for e-merchants that sell online through a platform, such as Cdiscount, Amazon, Rue du Commerce or Backmarket. It is an intermediary between the seller and the customer

- The PSPs (Payment service provider): manages the diversification of payments methods for e-merchants and takes commission on the sale amount. (Paypal for example)

- The Payments infrastructure for Marketplaces: such as MangoPay, gathers the role of the PSP and the marketplace at the same time. It manages the payment process, the e-wallet infrastructure and even the multicurrency payments.

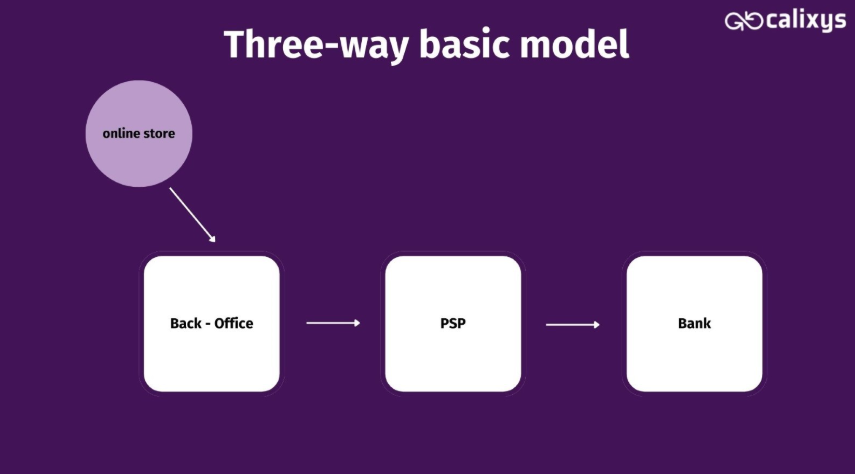

In our example we will first focus on the e-merchants model. The basic model for a business with an online store is this one:

BO (back-office) → PSP (payments) → Bank (wires)

- The Back-office records and tracks every activity on the online shop, which of course, includes purchase orders, date of the order, the payment method and amount of the order.

- Then, most companies use a PSP (Payment service provider) to manage the different electronic payment methods (credit or debit card, buy now pay later, cryptocurrency, Paypal, digital wallets, Amazon Pay …) and provide them with payment gateways and processors.

- Finally, the bank receives wire transfers that often aggregate 5 or 6 days of transaction on the PSP.

In this example the 3-way reconciliation will aim to make sure that every purchase order recorded in the back office aligns with a transaction recorded in the PSP and with a wire transfer recorded by the bank.

E-merchants are facing multiple challenges

On an online shop with a lot of activity, you can easily assume that the BO records thousands of orders a day, that gets also recorded by the PSP. With such a large volume of data and 3 diverse sources of recording, reconciliation can be a challenge.

And with that, you must add the fact that the PSP takes commissions on the transactions amounts, meaning that for a same purchase order recorded on your back office you might not directly find the same amount on the PSP records (as it subtracts its commission) This is why you will see a difference between the gross amount and the net amount on this two different data sources thus making you reconciliation more complex.

Now let’s take this example a step further. As said before the three-way reconciliation basic model includes the BO, the PSP, and the Bank as data sources. Now imagine you are an international seller and have created an online shop that sells in different currencies, in different countries and in different languages. Maybe you’ve even created several websites to address your different markets!

Can you see now how your 3-way reconciliation can easily become a multi-way reconciliation with 4, 5 or even 10 sources of record?

As if it was not enough, we must remind you that e-merchants, especially retailers, deal with a lot of other challenges, such as the diversification of payments methods, but also order returns & refunds, canceled orders, discount offers, loyalty programs, etc. All of which complexifies the reconciliation process.

In conclusion, one could say that multi-way reconciliation can be a challenge for a lot of companies and e-merchants in particular, since they must:

- Face the diversification of payments methods

- Manage a large volume of data from various sources

- Handle the disparity of stakeholders and services

- Make this data readable and intelligible despite complex mechanisms (returns, cancellations, …)

- Increase the accessibility and visibility of this data for different department within their company

It goes without saying that, just as solutions have been found to automate 2-way reconciliation, companies need to find a way to automate multi-way reconciliation, thus helping them to face these challenges better, faster and more accurately.

How does automatic multi-way transaction matching work?

Avoid multi-way single comparison systems

When it comes to choosing how you want to automate transaction matching you need to understand the difference between a multi-way global comparison and a multi-way single comparison system.

As we explained before, transaction matching always compares various sources of data. If there are only two different entries (like in a normal 2-way reconciliation) then it is not an issue. But if there are 3 or more entries (multi-way reconciliation) this is where things get complicated.

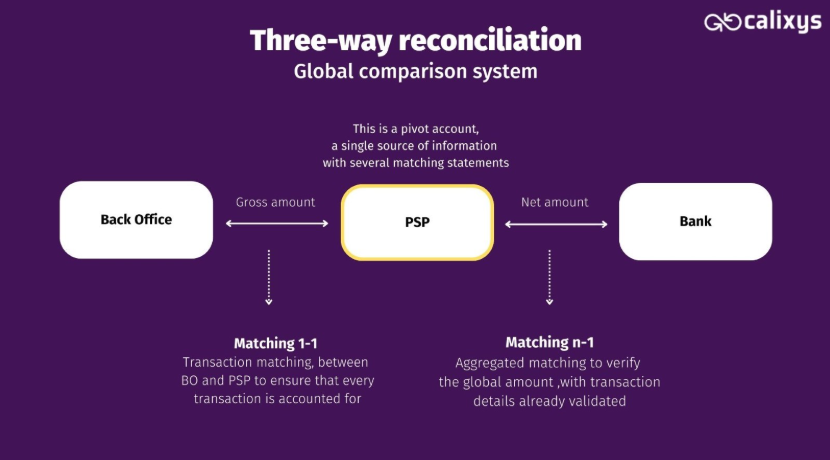

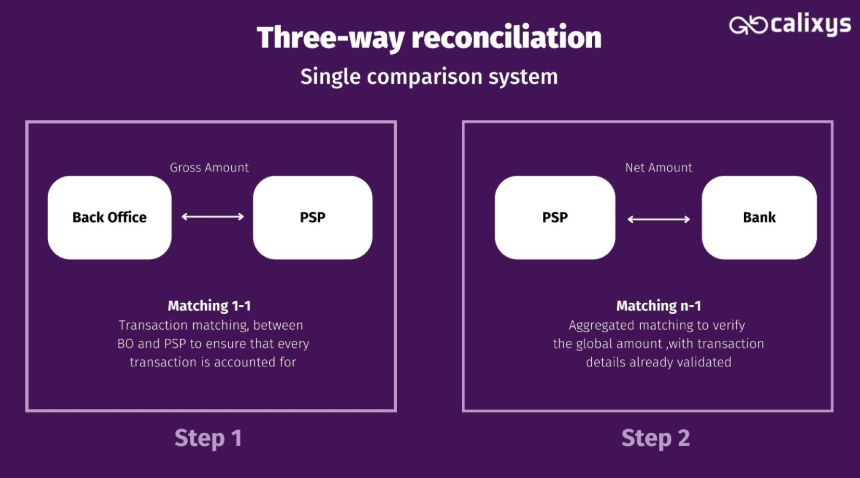

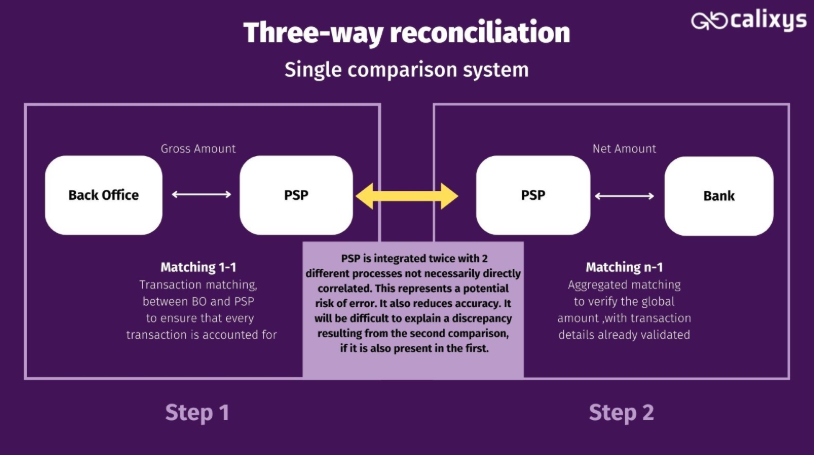

Let’s focus again on our e-merchant example. To compare the 3 different data sources of the BO, the PSP and the bank, we will first have to compare the data of the BO with the PSP, and then compare the data of the PSP with the bank and the data of the bank with the BO. Even if this sound simple, there are two different methods to do so:

You can clearly see here the 3 sources (BO, PSP, Bank). To reconcile these data if you choose the one-by-one approach (single comparison system) it will increase the risk of error and lack accuracy. The first method here (global comparison system) is not only quicker, but also more precise and offers you a global view of your results.

On a multi-way global comparison system, the software will compare these 3 sources simultaneously and give you 1 global analysis/result.

On a multi-way single comparison system, the software will compare these 3 sources one at a time. And give you 3 different analysis/results.

As this example is only a 3-way reconciliation, you won’t mind checking the results of three different comparisons, but keep in mind that when you scale this up, the second system will be more flexible and efficient.

Here 3 sources imply we must do 3 comparisons, but this is exponential. 5 sources force you to do 10 comparisons, 8 sources 28, 10 sources 45 …

Having to deal with more than 10 comparisons will sound like a nightmare to your IT department and yourself !

Avoid duplicity of comparisons

Another challenge is to avoid duplicity. If you have a one-by-one comparison system you might find yourself in this position :

As you can see here, the PSP is integrated twice, in two separate comparisons/ matchings. In a global comparison system, it would have been integrated once and used as a pivot account, to match aggregated data.

Automated transaction matching software will allow you to avoid these scenarios, especially if it uses a global comparison system.

In a nutshell:

Automated multi-way transaction matching can help you compare data from 3 or more data sources to do your reconciliations. Software can either use a single or a global comparison system, the key difference here being the centralization of the data, the risk of duplicity and the accessibility of the overview.

Automated multi-way transaction matching; the advantages of XREC for e-commerce : e-commerce

XREC is efficient

As for every automation, its main advantage for business is that it is timesaving. It allows you to have more time for tasks with added value and reduces the risk of making mistakes. It is also scalable, as it can handle a large (or even extremely large) volume of data in no time and increases the ROI.

XREC makes a complex task, easy

Reconciliation can be a challenging task, and it can be (over-)complexified by the large volume of transactions e-commerce businesses have to deal with on a daily basis. The process involves different stakeholders and data sources as well as calculation methods. Automating this task with efficient software makes it easier to handle multi-currency transactions, returns, various payment methods, discrepancies … With all this data, it can be hard to identify the problem and to know where to look for it. An automatic transaction matching solution targets the problem and lets you know where to find it !

XREC is tailor-made for each business and customizable

With XREC it is possible for you to choose:

- The data you need: you can choose which data to extract and to match to have exactly what you need and analyze your activity in depth.

- The level of tracking you need: as the information is centralized in the same place, you can track your transactions and reconciliations history for more than a year and stock it in your account.

- The visibility you need: as you can have an overview with a global comparison you can choose which view you need and cross results as you wish.

- The access you need: finally, as it is a collaborative solution, you can share different levels of access with the different departments involved and work together better

XREC streamlines and automates all reconciliation processes. Data collection, enrichment, matching, discrepancy detection and classification, resolution workflow allocation, justification, archiving.

Reduce your dependence on obsolete spreadsheets and tools. Centralize and harmonize all your reconciliation processes on a robust, high-performance application base.

Reconcile and control all your PayIn and PayOut payments on a single platform with multi-way technology.

Integrate and reconcile very high transaction volumes quickly and easily, with no loss of performance.

Significantly reduce operating costs. Refocus your teams on high value-added activities. Gain compliance thanks to a complete audit trail.

Reduce data completeness and quality issues. Make decisions based on reliable data.

XREC is an end-to-end solution

From record to report, you can have a 360° view of the entire information processing chain, enabling you to solve specific problems. It is the centralization of the information that makes the difference here, saving you precious time gathering the data or identifying the discrepancies. It also makes it more reliable and easier to access.