Transactional reconciliations: automate your flows with precision

An increasing volume of payments and transactions passes through your systems every day. Without automation, reconciliation becomes time-consuming, risk-laden, and a source of discrepancies. With XREC, align your transactional flows — across all sectors — to gain reliability, speed, and visibility.

Transactions across all sectors

Transactional reconciliations applied to your industry

Transactional reconciliation is one of the most widespread needs in finance departments. Whether online payments, in-store, banking flows, insurance, or internal operations, it ensures consistency between what is recorded, collected, and disbursed. Here are some concrete applications.

E-payments reconciliations

Ensure every e-commerce or marketplace transaction is properly recorded, collected, and transferred to the correct beneficiary. Orders, PSPs, refunding and incoming payments are all reconciled automatically.

Insurance & services

Premiums, claims, subscriptions, or service invoices: ensure consistency between invoiced amounts and payments received to guarantee compliance and reliable control.

In-store/ Physical payments

Align payments made in store or at a counter with bank deposits and terminal/payment device statements. Returns and cancellations are also included.

Internal & inter-entity transactions

In multi-entity or industrial groups, consolidate intercompany flows: supplier invoices, down payments, cash movements. Obtain a unified vision and eliminate consolidation discrepancies.

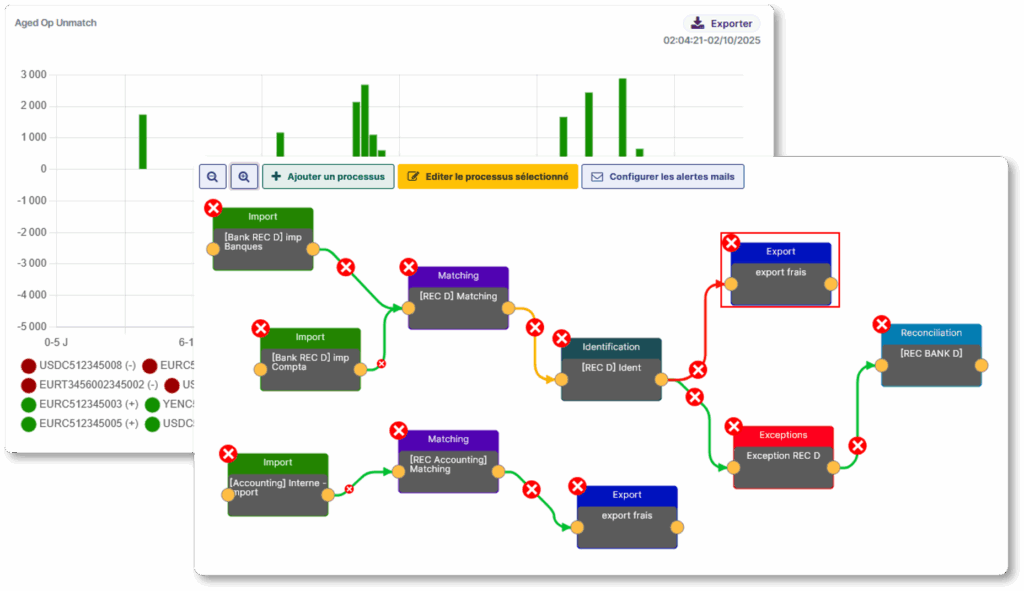

Simplify all your transactional reconciliations with the power of a single platform

Manage complexity

Our intelligent transactional matching engine handles both simple cases (1:1) and more complex scenarios (1:n, n:1, n:n). Down payments, partial refunds, multi-installment payments: every transaction is reconciled automatically without loss of precision.

Handle diversity

We connect all your data sources: ERP, PSP, banks, POS systems… as well as all payment methods (card, direct debit, cash, bank transfer). This multi-channel and multi-format integration removes manual exports and ensures continuous reconciliation.

Personalize

Every organization has its own validation processes and discrepancy handling. Our platform lets you define your business rules, tolerances, and collaborative workflows. You decide who validates, who corrects, and at what stage — all while maintaining full traceability.

Monitor and control

Transactional dashboards, audit-ready reports, exception tracking: you gain a clear, instantaneous view of your flows. This transparency simplifies your closings, internal controls, and regulatory obligations.