Automate Your Bank & Accounting Reconciliation: Gain Speed, Reliability & Compliance

Bank & accounting reconciliation is an essential pillar for ensuring financial data integrity and regulatory compliance. With the growing number of accounts, banks, and currencies, reconciliations are becoming increasingly complex. With Calixys, turn this constraint into a strategic lever: reduce costs, speed up closes, and improve data quality so you can manage your finances with full confidence.

Speed, performance and accuracy

Reconcile your bank and accounting records with confidence

Automating your reconciliations means cutting up to 80% of manual tasks, making your data more reliable, and accelerating your closing periods by several days. With Calixys, you gain productivity, reduce error risks, and enhance the quality of your reporting. ROI is both fast and measurable thanks to better control of discrepancies, strengthened compliance, and real-time visibility into your financial flows

Free up your teams

Reduce manual tasks and give your teams more time for analysis and resolving discrepancies.

Compliance and traceability

Ensure full traceability and simplify audits with centralized, secure tracking of operations

Clear and precise visibility

Access real-time visibility to anticipate risks and improve strategic steering.

Reduce costs and accelerate ROI

Automate reconciliations to decrease operating costs, shorten closing periods, and achieve a fast, measurable return on investment.

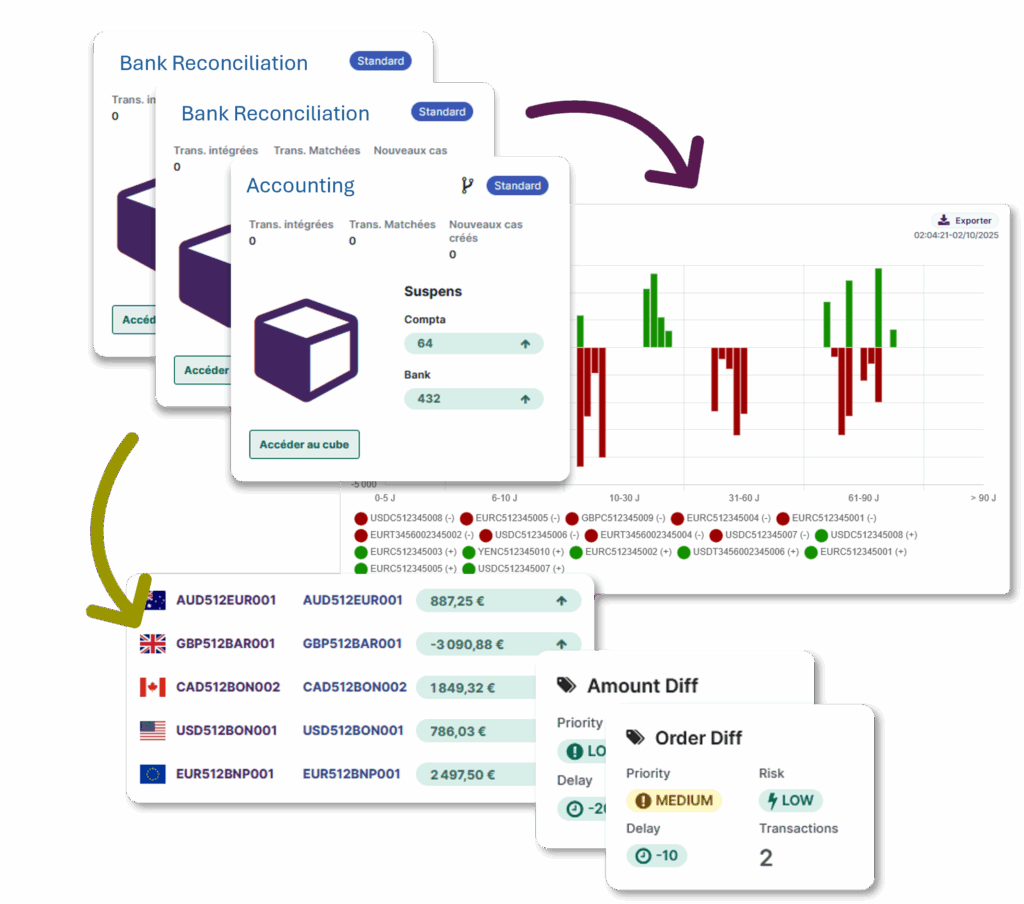

An end-to-end platform for complete and reliable automation

Calixys automates the entire bank & accounting reconciliation process: integration, matching, discrepancy management, reporting, and audit. A full solution to ensure data reliability, reduce risks, and optimize your closing even at large scale.

Fast, smooth integration with your information systems

Connect Calixys to your ERPs and existing systems easily, with quick implementation and real-time synchronization.

Security and compliance of exchanges

Ensure confidentiality and regulatory compliance through secure protocols and enhanced controls over all your financial data.

Centralization and standardization for simplified management

Gather all your bank and accounting data in a single platform to standardize your processes and simplify multi-entity oversight.

Manage and classify discrepencies efficiently

Identify, classify, and handle your discrepancies with automated workflows and smart notifications to speed up resolution.

Flexible and intelligent matching rules

Apply simple or complex rules tailored to your flows, with an intelligent engine to maximize accuracy and reduce manual interventions.

Automated and compliant accounting exports

Generate and export your accounting entries to your ERPs automatically, in full compliance and without risk of error.