Take control

of your flows in an omnichannel retail environnement

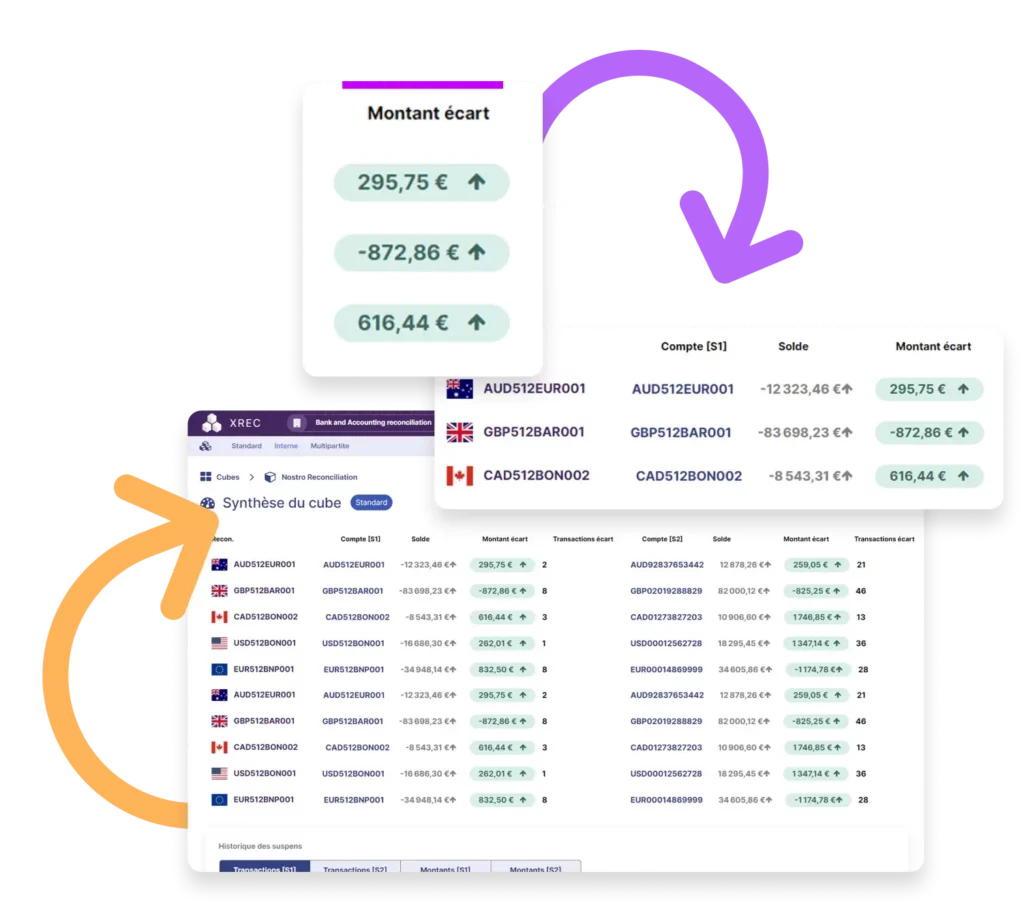

With XREC, you centralize, automate, and secure reconciliation of all your sales flows. You gain a consolidated, actionable real-time view from initial payment to refund, with no breaks in traceability. Your teams no longer suffer under data—they drive it.

Calixys will be at Tech for Retail 2025

to present its solutions build for performance in a fast moving sector.

Automate, manage, detetect

Gain operational efficiency and control over your flows

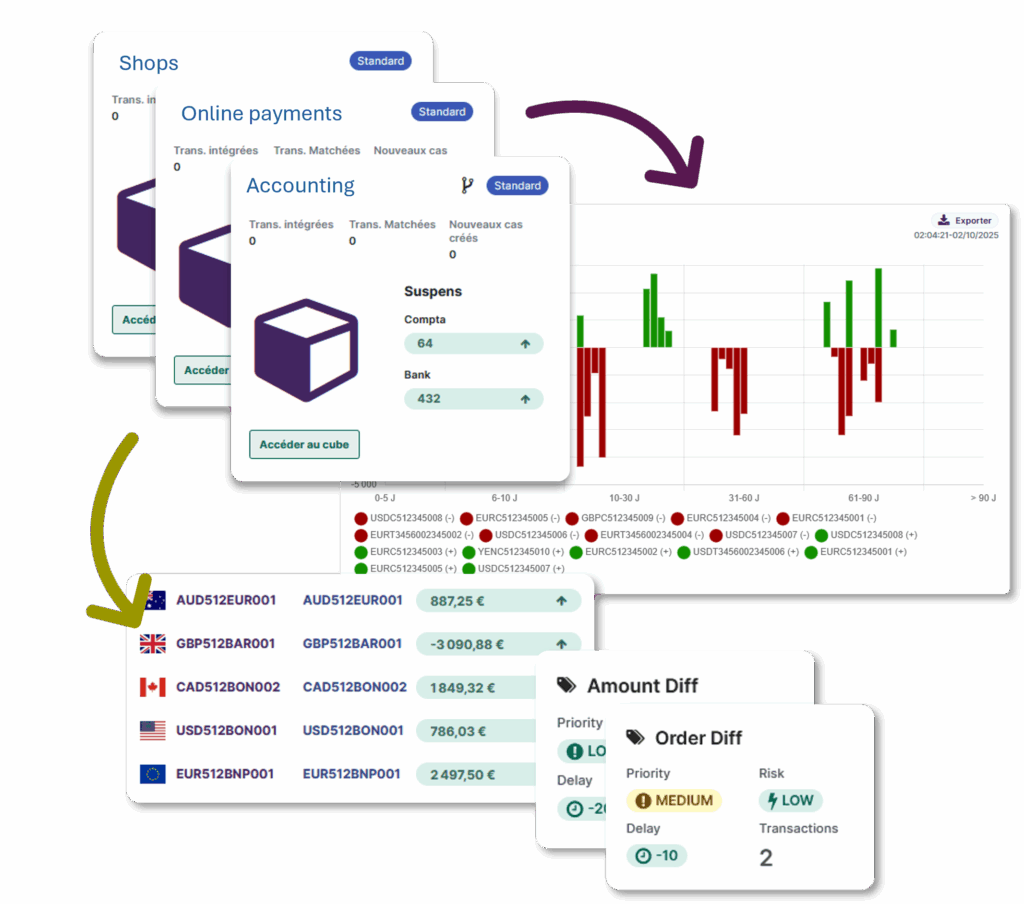

Between physical stores, e-commerce, click & collect, marketplaces, and promotional operations, retailers’ financial flows are becoming highly complex at breakneck speed. The result: unresolved discrepancies, delayed closings, lack of visibility over collections, and fraud detection often reactive rather than preventative.

Free your teams from manual tasks

XREC automates collection, matching and justification of transactions. Your teams gain time for analysis and optimization. The platform handles your volumes, even during peak periods. Fast and accurate reconciliation, regardless of commercial intensity.

Manage reliable actionable data

All your transactions centralized in a single source of truth. Continuous tracking from first payment to final accounting entry. Consolidated view by channel, point of sale and payment method. Discrepancies are detected and resolved quickly, yielding reliable, usable data.

Detect and prevent fraud effectively

By integrating all your sources (POS, ERP, PSP, e-commerce…), XREC spots inconsistencies and anomalies as soon as they appear. Transaction-level granularity enables identification of suspicious behaviors, thereby reducing losses and reputational risks.

Features designed for multichannel retail

Whatever the channel—store, online, click & collect, vending machines, foreign sales—XREC reconciles every transaction against its financial reality. Card, cash, cheque, instalment payments, store credits, refunds: everything is automatically traced and justified. Centralize all your receipts on a unified interface.

Whether they come from your physical stores, your overseas points of sale or your digital channels, all your inflows are reconciled according to the same logic—without silos or manual re-entry.

Transactional cross-channel reconciliation

No matter the channel, XREC matches every transaction to its financial reality. Card, cash, cheque, instalment, store credit, refunds: everything is traced and automatically justified. Centralize all your payment receipt flows in a unified interface. Whether sourced from abroad or digital channels.

Customization : configurable business rules

With XREC, you model your reconciliation rules according to your internal processes: tolerances, priorities, validation conditions, matching or exclusion rules. The platform lets you adapt reconciliation logic for each type of flow—with no compromise between automation and control.

Automatic deposit matching and cash register closing

Each deposit is automatically matched with your references and banking data. Discrepancies are identified in real time, your closings made reliable, and anomalies resolved without delay. In this way, you avoid errors, delays, monitor fraud and ensure accurate figures.

Dispute, chargeback, cancellation management

XREC reconstructs disputed flows and secures client refunds or chargebacks. You retain full traceability, whatever the channel or transaction type.

Transactional granularity and full visibility

The platform allows you to follow a transaction from the act of purchase to its accounting record, passing through all intermediate systems. No breaks in visibility, no flow forgotten.

Scalability : support your growth

International expansion, new entities, acquisitions—our solutions are flexible and scalable. Our models are replicable to support each stage of your development with a few clicks

Full functional coverage for the retail industry

You reconcile all payments made in-store (card, gift vouchers, automated tills, etc.) in a reliable and robust system capable of processing large volumes of data. All consolidated information is fed back to headquarters, regardless of number of stores, payment method diversity, or geographic location.

They decided to strenghten their reconciliation process with us

Retail leaders already optimize their reconciliation with Calixys

The teams at Leroy Merlin trusted us to speed up and secure reconciliation of their online flows, as well as their 144 points of sale across France.

Discover our solution in 10 minutes !