From premium to claim : master every flow in full compliance

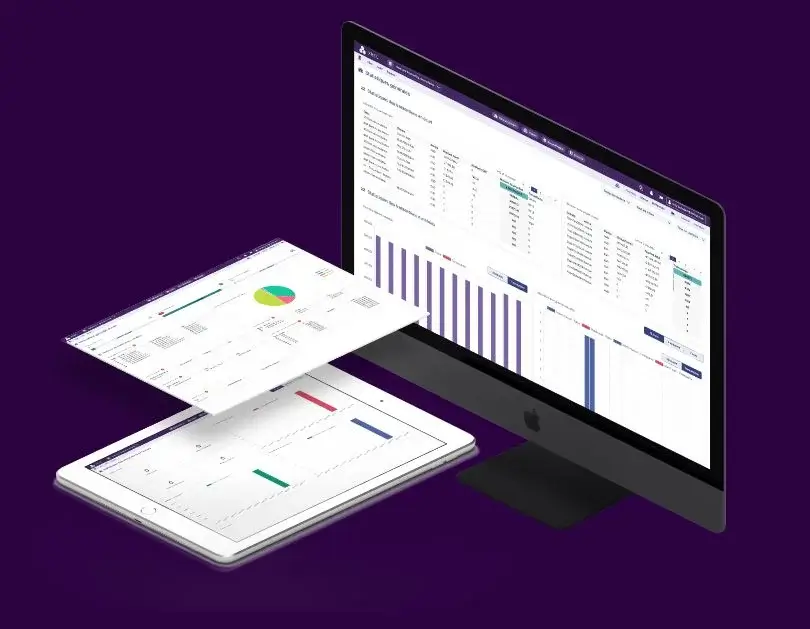

With XREC, you automate and secure your reconciliations, while gaining an end-to-end consolidated and actionable view. Your teams shift from chasing discrepancies to analysis and strategic control.

Fight against endless reconciliations

Unify, automate, and secure your insurance reconciliations in a complete and robust platform

Between premium management, claims, technical provisions, and investments, finance departments at insurance companies must process a colossal volume of data coming from multiple sources.

To this operational complexity are added strict regulatory requirements (IFRS 17, Solvency II, SOX…), often heterogeneous systems, and still massive reliance on manual work.

Automate your reonciliations

Only 4% of insurers have fully automated their reconciliation processes, but most still use Excel sheets or macros.

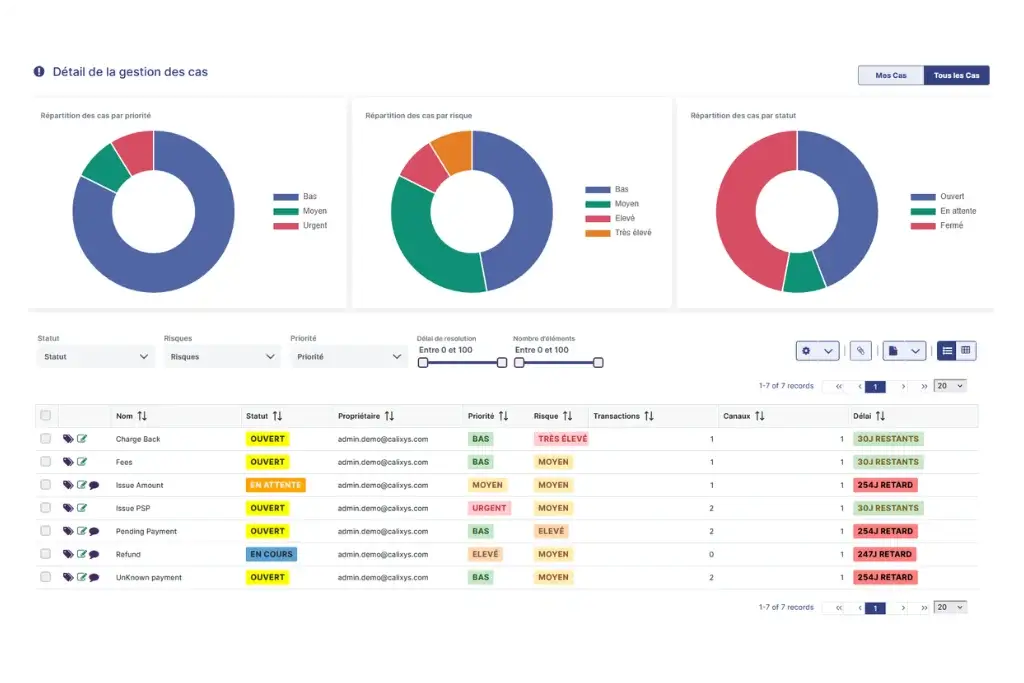

With XREC, every flow is collected, normalized, and reconciled automatically, whatever its source. Discrepancies are isolated in real time, so that your teams can finally focus on resolving exceptions and on management oversight.

Ensure permanent compliance

IFRS 17, Solvency II, SOX… regulatory pressure demands impeccable traceability.

With XREC, every reconciliation is logged, timestamped, and justified with all supporting documents. During an audit, your data is ready immediately, and each transaction can be reconstructed precisely, even years later.

Centralize despite fragmentation

Between legacy systems, brokerage tools, multiple databases, and acquisitions, your data is dispersed and heterogeneous.

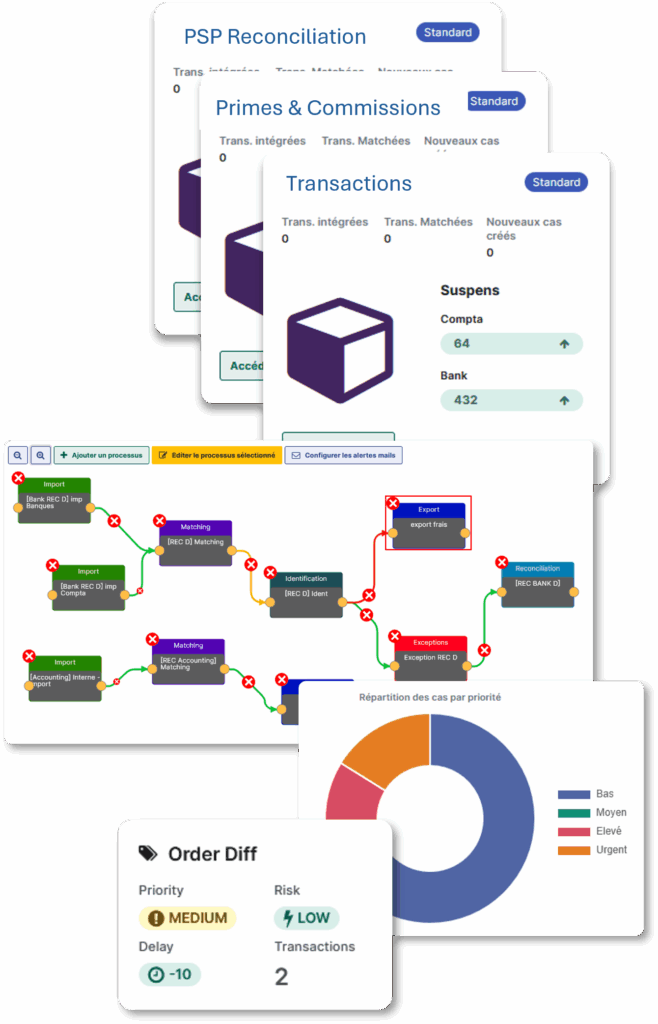

XREC automates ingestion and matching of flows from all your systems (policy management, claims, brokerage, reinsurance, investments…), to offer a unique consolidated view and reduce discrepancies as soon as they appear.

End-to-end functional coverage for your specific challenges

Specialized reconciliations across all your flows

XREC handles your most complex use cases:

- Premiums & policies: tracking from issuance to collection

- Technical provisions & reserves: justification of amounts and variances

- Commissions: reconciliation with brokers and partners

- Claims & reimbursements: control of payments, reimbursements, and subrogations

Multi-entity and multi-currency vision

Whether you operate in multiple countries or currencies, XREC ensures conversion, allocation of costs, detection of forex-related discrepancies, all while consolidating everything into global reporting.

Flexible ETL to integrate all your data

Our integration engine accepts all formats: flat files, APIs, databases, structured or semi-structured documents. You can enrich and categorise your data to facilitate checks and speed up analysis.

Pro-active detection of anomalies and fraud

Thanks to configurable business rules, XREC quickly identifies unusual variances, duplicates or suspicious patterns. You act before they affect your accounts or compliance.

XREC : a unique solution for all your reconciliations

Leading names in insurance already optimize reconciliation with Calixys

Generali, Nortia, MACSF and Aésio have placed their trust in us