Banks & Neobanks — Automate your end-to-end reconciliations, gain performance and compliance

Calixys supports banking institutions in optimizing and automating their reconciliation and accounting certification processes through a single, intuitive platform that offers full functional coverage.

What benefits for your teams ?

A robust High-performance platform to optimize your financial processes

In the complex and ever-evolving financial world of banking, managing financial flows is essential to ensure accuracy, transparency and operational compliance.

Banks face major challenges around transaction reconciliation, discrepancy management, and regulatory compliance.

Secure your critical flows and strengthen governance with a cloud-native platform

Highly available, scalable, resilient cloud-native architecture, with open APIs to integrate with your IT systems (core banking, GL, payments, securities, treasury), while ensuring end-to-end encryption.

Modularity and full functional coverage

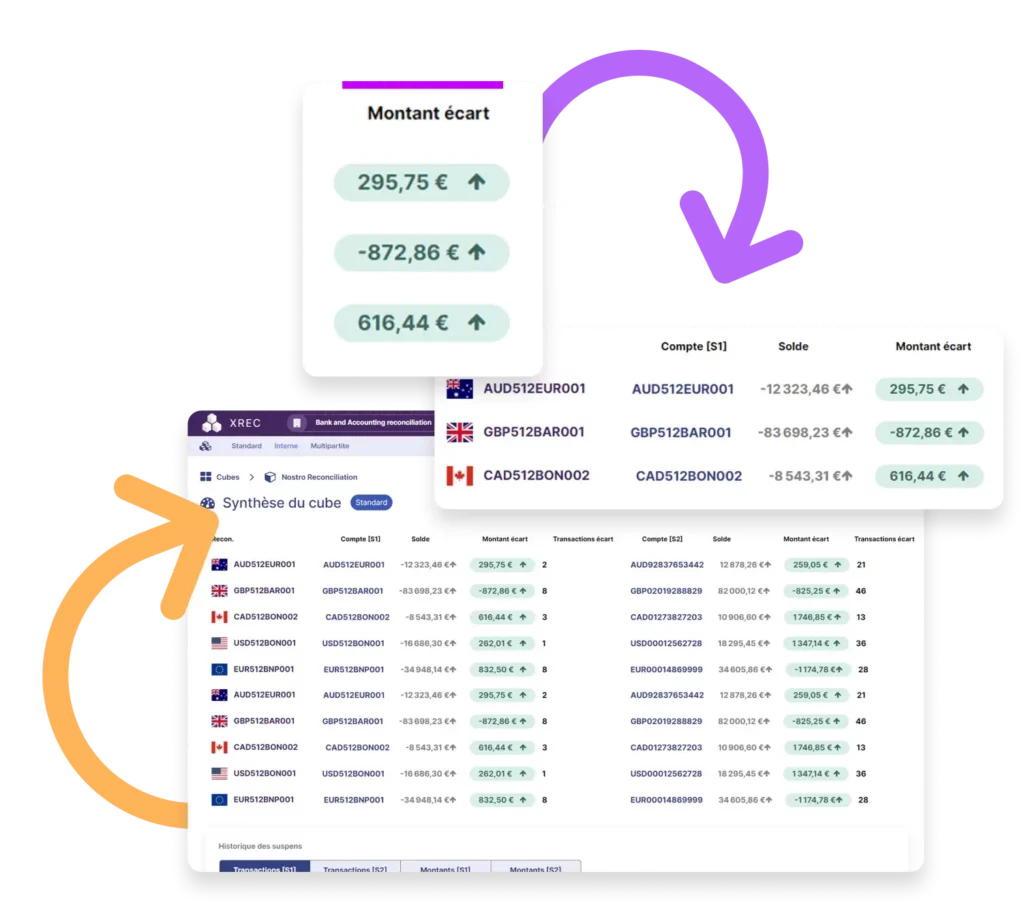

A modular and scalable design meant to cover all your needs: bank reconciliations, inter-company, cards, Nostro/Vostro, GL vs sub-ledgers, payments… Our platform handles massive volumes in real time, while providing advanced automation and intelligent workflows to make your financial processes reliable.

Invest in a future-oriented sustainable model

Reconciliation can only be truly effective if conceived as a global, interconnected, and managed process. For sustainability, the reconciliation process and tools must be flexible and adapt to regulatory, technological, and structural changes. Our solutions ensure scalability, customization, and flexibility with each change to make your models sustainable and replicable, your processes agile, and your investment durable.

80 %

of manual tasks eliminated

75 %

of unjustified discrepencies reduction

25 %

of direct savings on operational costs

Ensure consistency across your internal accounts, clearing accounts, third-party accounts, and inter-system flows. XREC detects imbalances, duplicates, or omissions in internal movements—whether they relate to treasury, accounting, or risk management.

Manage reconciliations that involve multiple parties—banks, PSPs, customers, partners, or internal systems. XREC cross-checks and aligns data flows from numerous sources, using advanced matching rules and granular exception handling. The platform ensures full traceability and enables fast resolution of complex discrepancies.

Automate the reconciliation of Accounts Receivable and Accounts Payable with your banking and accounting flows. XREC streamlines the identification of incoming and outgoing payments, supports accurate tracking of collections and disbursements, and improves dispute management. An ideal solution to strengthen sub-ledger accounting and enhance cash visibility.

Synchronize internal master data (customers, accounts, products) with those of partners, banks, or third-party systems. XREC identifies inconsistencies, duplicates, or mapping errors and makes them easier to correct. A solid foundation for strengthening the reliability of all other reconciliation processes.

Optimize the monitoring of all operations performed on ATMs. XREC reconciles event logs, withdrawal flows, and accounting entries while detecting both technical and financial anomalies. The platform enables precise incident oversight and helps reduce losses tied to unresolved discrepancies.

Centralize and reconcile all payment service provider (PSP) flows with your accounting and banking records. XREC automates the processing of transaction files, payout reports, and fees while ensuring full traceability. The platform simplifies multi-PSP management and enables fast detection of discrepancies or settlement delays.

Manage the reconciliation of payment card flows with precision: card transactions, payment switches, VISA network, GIM-UEMOA. XREC processes high volumes in real time, identifies discrepancies between acquirers, banks, and accounting systems, and streamlines dispute resolution.

Synchronize physical flows (deliveries, returns) with financial flows (invoices, payments). XREC reconciles data from ERP, accounting, and banking systems to detect discrepancies related to timing, quantities, or amounts. A valuable solution for banks involved in asset financing or leasing activities.

Build your digital reconciliation platform today

Strengthen your operational control and financial governance with a single platform that centralizes all your flows, automates reconciliation and discrepancy management with precision, makes your handling of complex operations reliable, and provides full functional coverage up to certification.

Centralize all your financial flows

Credit card transactions, transfers, direct debits, ATM withdrawals, interbank transfers… A bank’s financial flow is sprawling. With our solutions, you centralize and structure this data in one platform, regardless of volume or source — multi-entity or multi-currency environment.

Ensure reliable reconciliation

XREC covers all your reconciliations: cash, positions, fees, payments, Nostro/Vostro, GL vs sub-ledgers, inter-company, SWIFT (MT/MX, ISO 20022). Advanced matching (N-way), deterministic & probabilistic rules, prioritization. Integrated workflows: assignments, SLAs, attachments. Periodic account certification with full audit trail.

Manage exceptions effectively

Automatic classification of discrepancies by type and reconciliation cube. Fully configurable tolerance and exception rules. Precise tracking, traceability and rapid anomaly handling. A reliable process adapted to growing transaction volumes.

Accelerate accounting close

XCERT structures and secures your accounting justification cycles. Management of deadlines, centralized supporting documents, integrated workflows. Data quality controls, normalization and ready-to-use connectors. Repository compliant with regulatory and auditing requirements of the banking sector.

Banks et neo-banks have entrusted us with their reconciliation

From historic leaders to fintech actors, traditional banks or investment banks — we support stakeholders across the sector. Our goal: to meet their needs and transform their processes to adapt everyday to their reality. Milleis Bank, Edel Bank, Xpollens, Nickel, Banque Populaire du Maroc and many others have trusted us.

Discover our solution in 10 minutes !