Automated reconciliation software to streamline financial processes

From data ingestion to exception resolution, our solution automates every step of your reconciliation process.

Gain full visibility, improve compliance, and save valuable time — all in one platform.

A new generation platform for your financial team

Whether you’re a bank, retailer, e-commerce company, asset manager, or any other business, the transaction reconciliation process can be a challenging and time-consuming task. We standardize and automate all financial data reconciliation processes: data collection, enrichment, matching, discrepancy detection and classification, resolution workflow allocation, justification, and archiving.

Automate

The processes of reconciliation, classification of discrepancies, assignment, control and reporting.

Improve

Precision, but also speed and reliability of operations.

Control

By increasing overall and transactional visibility, as well as tracking team performance.

Strenghten

Profitability

By reducing costs, those of compliance, those linked to reconciliation errors and human errors.

Custom

By configuring business rules as needed (identification rules, tolerance classification rules, etc.)

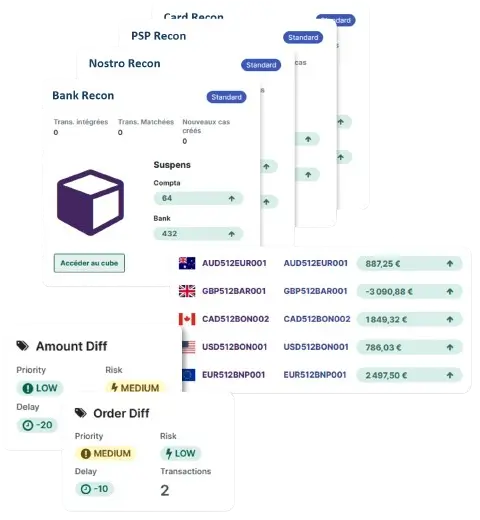

Quickly and easily match and reconcile your financial data with our Reconciliation software

A flexible, high-performance foundation

The Xrec reconciliation solution benefits from proven software technology combining simplicity, ergonomics and performance.

Xrec has been designed for total flexibility of configuration and parameterization (data input and output formats, matching rules, processing orchestrator, automatic gap management, dashboard, consultation screen, etc.) to meet all types of reconciliation requirements.

Automatic exception handling

Rapidly reconciling data is all well and good, but automatically identifying and classifying discrepancies is even better. Xrec’s exception management module automatically identifies and classifies discrepancies by type, according to your criteria. You won’t waste any more time, and you’ll be able to concentrate on the essentials.

Millions of data transactions effortlessly

XREC peut gérer sans complexe des volumétries de plusieurs centaines de millions de transactions par jour sans perte de performance. Vous n’êtes plus obligé d’agréger vos données pour vos rapprochements. Cela vous permet de garder un niveau de détail important pur vos contrôles et analyses.

Automatic discrepancy analysis and management

Reconciling data quickly is great; identifying and classifying discrepancies automatically is even better! XREC’s exception management module identifies and classifies discrepancies by type based on your criteria, eliminating the time spent interpreting them.

Verify, validate, collaborate

As a 100% web-based platform, XREC enhances collaboration across teams and departments. Data accessibility is no longer siloed, improving communication significantly. Differentiated connection profiles allow you to control, assign roles, align with your validation processes, and facilitate collaboration with external stakeholders.

Analyze, create reports & export

With XREC, report generation is automated. Based on your predefined reconciliation cubes and accounts, you receive customizable reports automatically. Track activities,outstanding transactions, discrepancy types, team performance, matching rates, and more. Regulatory reporting is also simplified with customizable reports, full traceability,and a complete history of operations by reconciliation account. You can easily export reports and data, giving you reliable insights for decision-making.

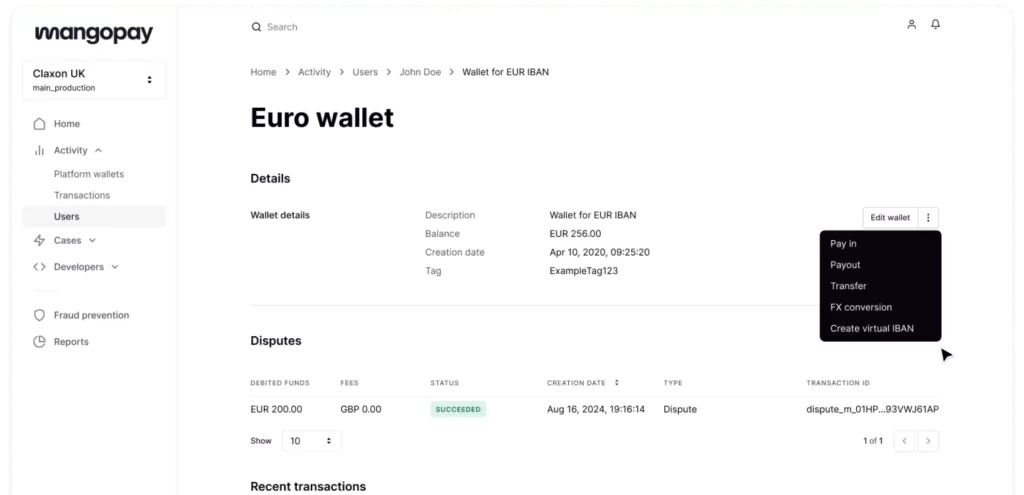

Automated reconciliation software in 6 steps :

-

Data import

Data import

-

Data management

Data management

-

Data matching

Data matching

-

Break management

Break management

-

Regularisation Workflow

Regularisation Workflow

-

Reporting & Analysis

Reporting & Analysis

Flexible ETL

Flexible ETL

Imported data is standardized and enriched to ensure perfect consistency across different sources. This process ensures format harmonization and optimal data preparation for the next steps of reconciliation. You have control over data categorization and mapping.

Transformation & enrichment

Transformation & enrichment

Different currencies or import formats are harmonized to ensure a uniform basis for comparison and matching. This means you can easily manage multi-currency, exchange rate differences, and flat file formats generated by your other tools.

Data mapping

Once your data is imported, you can easily organize it according to your internal processes and future reconciliations. Create a custom data path, by entity, currency, country, etc. Distribute them across your cubes for greater efficiency.

Our intelligent matching engine automatically associates transactions using advanced algorithms. Whether using deterministic rules or AI-powered analytics, the solution identifies exact matches and significantly reduces manual processing time.

Multyway reconciliation

Multyway reconciliation

In addition to enabling all types of reconciliations, our platform also has a dedicated module for your most complex reconciliations: the multi-party module. With a simplified view of your different sources, you can monitor these reconciliations closely and remove the complexity of these operations.

When a discrepancy is detected, it is categorized and analyzed to propose an automatic allocation according to predefined rules. This feature allows you to immediately identify the nature of the differences and streamline their processing.

Exception

Once the matching process is complete, you can access the list of unmatched operations and categorize them as exceptions. This process is also automated to save you as much time as possible.

Automatic classification

You define rules for classifying discrepancies according to their type. You control this operation based on your business knowledge and trends already identified in the past. Once the settings are established, the tool will automatically classify discrepancies into their respective types: duplicate, input error, anomaly, orphan…

To efficiently manage unresolved discrepancies, our solution integrates an automated regularization workflow. It allows you to assign actions to the right teams, track the progress of corrections, and accelerate resolution through integrated notifications and validations.

Assign

Assign

Once identified and classified by type, discrepancies can be assigned to each team member for analysis and resolution. This streamlines collaboration processes and ensures greater efficiency in addressing discrepancies.

Justifiy

In addition to the assignment, each member can justify or explain their discrepancy by annotating it, attaching supporting documents or invoices, all of which can be viewed in the regularization tracking module. This way, unresolved discrepancies are easily traceable and directly understandable.

The solution generates detailed and customizable reports, providing complete visibility into the reconciliation process. These interactive dashboards facilitate the monitoring of key indicators, the auditability of transactions, and the continuous improvement of financial management.

Lead teams

Monitoring dashboards are available to better track team progress on tasks, reconciliations, and resolutions. Also, and most importantly, to ensure complete traceability of actions taken for each reconciliation account.

Track performance

Track performance

Overviews are also available to verify the alignment of actions taken, the overall matching rate, and conduct comparisons over time. These reports are also customizable to align with your internal objectives.

-

Data import

Data import

-

Data management

Data management

-

Data matching

Data matching

-

Break management

Break management

-

Regularisation workflow

Regularisation workflow

-

Reporting & Analysis

Reporting & Analysis

Flexible ETL

Flexible ETL

Imported data is standardized and enriched to ensure perfect consistency across different sources. This process ensures format harmonization and optimal data preparation for the next steps of reconciliation. You have control over data categorization and mapping.

Transformation & enrichment

Transformation & enrichment

Different currencies or import formats are harmonized to ensure a uniform basis for comparison and matching. This means you can easily manage multi-currency, exchange rate differences, and flat file formats generated by your other tools.

Data mapping

Once your data is imported, you can easily organize it according to your internal processes and future reconciliations. Create a custom data path, by entity, currency, country, etc. Distribute them across your cubes for greater efficiency.

Our intelligent matching engine automatically associates transactions using advanced algorithms. Whether using deterministic rules or AI-powered analytics, the solution identifies exact matches and significantly reduces manual processing time.

Multyway reconciliation

Multyway reconciliation

In addition to enabling all types of reconciliations, our platform also has a dedicated module for your most complex reconciliations: the multi-party module. With a simplified view of your different sources, you can monitor these reconciliations closely and remove the complexity of these operations.

When a discrepancy is detected, it is categorized and analyzed to propose an automatic allocation according to predefined rules. This feature allows you to immediately identify the nature of the differences and streamline their processing.

Exception

Once the matching process is complete, you can access the list of unmatched operations and categorize them as exceptions. This process is also automated to save you as much time as possible.

Automatic classification

You define rules for classifying discrepancies according to their type. You control this operation based on your business knowledge and trends already identified in the past. Once the settings are established, the tool will automatically classify discrepancies into their respective types: duplicate, input error, anomaly, orphan…

To efficiently manage unresolved discrepancies, our solution integrates an automated regularization workflow. It allows you to assign actions to the right teams, track the progress of corrections, and accelerate resolution through integrated notifications and validations.

Assign

Assign

Once identified and classified by type, discrepancies can be assigned to each team member for analysis and resolution. This streamlines collaboration processes and ensures greater efficiency in addressing discrepancies.

Justifiy

In addition to the assignment, each member can justify or explain their discrepancy by annotating it, attaching supporting documents or invoices, all of which can be viewed in the regularization tracking module. This way, unresolved discrepancies are easily traceable and directly understandable.

The solution generates detailed and customizable reports, providing complete visibility into the reconciliation process. These interactive dashboards facilitate the monitoring of key indicators, the auditability of transactions, and the continuous improvement of financial management.

Lead teams

Monitoring dashboards are available to better track team progress on tasks, reconciliations, and resolutions. Also, and most importantly, to ensure complete traceability of actions taken for each reconciliation account.

Track performance

Track performance

Overviews are also available to verify the alignment of actions taken, the overall matching rate, and conduct comparisons over time. These reports are also customizable to align with your internal objectives.

How XREC automate your data reconciliation in 6 steps

Ready-to-use

- Easy to use: intuitive solution,designed by experts for experts

- Comprehensive and modular suite: Tailored to your needs

You are not alone

- Expert support: from project creation to go-live

- Dedicated assistance: a support team always at your service

- Proximity consulting: For all your projects

- Team training: customized sessions for your staff

Scale & Upgrade

- Resilient model: Replicable IT processes that accelerate deployment capacity

- Scalable solution: Consistently high performance, no matter the data volume

- Adaptability: Flexible enough to scale with your growth, team, and business

Let’s talk numbers

XREC is cost-effective:

Clients typically see ROI within 6 months on average

Reduce financial losses:

XREC’s accuracy and speed minimize risks of human error, non-compliance (and associated penalties), and save your finance teams over 5,000 hours annually.

Volume is no issue:

With millions of transactions reconciled every year, XREC is robust, powerful, andscalable enough to handle fluctuations in volume while maintaining peak performance.

Accuracy isn’t either!

XREC users report an average matching rate of 98%.

Wherever you are, XREC delivers:

Deployed in 144 countries, its multi-currency modules, exchange rate updates, and resilient replicable models support your international growth.

Your data is in good hands!

XREC is secured with data hosted in Europe and adheres to top-level : two-factor authentication, encryption, and sensitive data anonymization, fully compliant with GDPR standards.

Archive, export—it's up to you!

With substantial storage capacity, you can archive data and reports to ensure better traceability over time and conduct more in-depth analyses of process efficiency.

Everything is compliant!

Regulatory reporting is simplified with real-time reconciliation data updates, whether in batches or ongoing. These features ensure you’re always audit-ready with a real-time overview.

Hear it from our clients

“CALIXYS provides GENERALI France with its advice and all its expertise on the issues of reconciling financial and accounting data. We have been able to set up the automation of a very large number of data reconciliations.“

Christophe PRIVAT

Manager Commissionnemet, GENERALI

“The power and adaptability of the XREC solution, given the diversity of matching rules we need, makes this tool a central element in monitoring our daily operations.”

Alexis Michard

Head of finance and accounting, Orange Bank

“XREC’s flexibility, rapid implementation of functional needs, and active listening by CALIXYS teams make XREC an essential tool for ensuring optimal control and monitoring of MANGOPAY’s transactional flows, but also supporting the significant growth of the company and the flows under management.“

Finance team

MANGOPAY